With so much news in the press surrounding companies raising millions in venture capital, it’s easy to forget about another well-regarded type of funding called venture debt.

In part three of the four-part venture debt guide, you will find out who wins in the capital clash between Venture Capital vs Venture Debt.

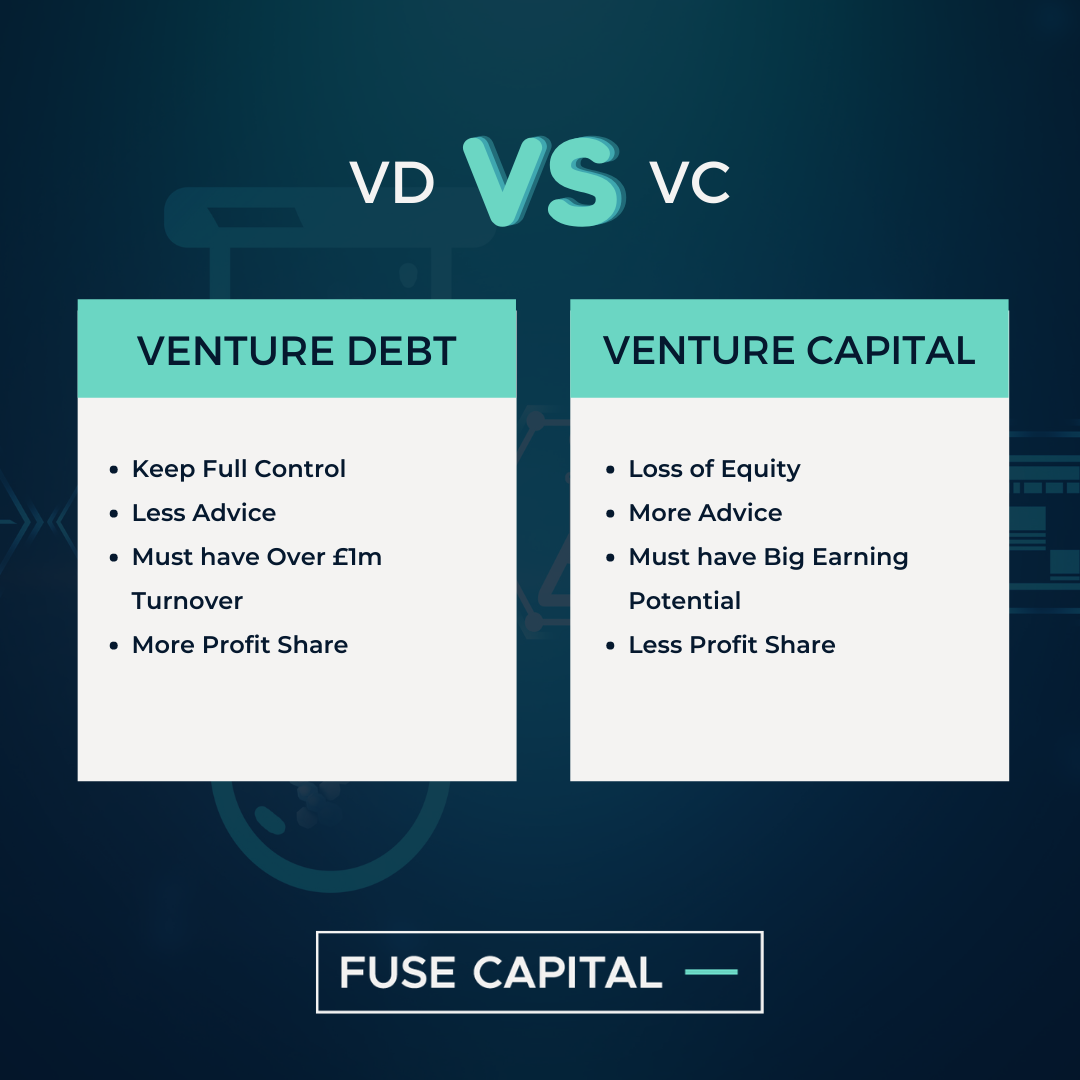

In its simplest form, both lenders want their money back, but one takes a stake in the company and the other does not. Read on to find out more.

Use the contents section below to skip to specific areas of interest.

What does Venture Capital do?

Venture capital invests in immature start ups to help them achieve critical milestones which are integral to increasing the companies value.

In return for investment, entrepreneurs issue them stock in the company to get them over the line.

Companies who take Venture Capital often look like this:

- Their cash flow is weak and unpredictable

- They don’t have a meaningful brand recognition

- They’re young and can’t pay back a loan

The Advantages of Venture Capital

There are several advantages to taking Venture Capital. The first is expertise and guidance from your VC. You can bet they’ve dealt with a multitude of businesses like yours and can face complex challenges with confidence. This is especially valuable for a young, expanding business experiencing growing pains.

The next advantage is their connections. Your highly connected VC will introduce you to new people and new opportunities, an essential ingredient for building towards success.

Lastly, another prop in a VC’s closet is their expertise in law and tax. Another specialist area which with the right knowledge, can propel your company to success.

Uses of Venture Capital

Although challenging, these common business milestones are understood by VCs. These Use of Funds are what Venture Capital is made for.

#1 Seed Stage – At this stage, the company is at a very early stage, this may be when the company is planning on a hard launch for a product and needs capital to drive it.

#2 Startup Stage – This stage requires a larger amount of capital to aid advertising and marketing of new products or services to new customers, this is the customer acquisition stage which is vital to any new venture.

#3 First Stage – The company is starting to look at expansion and further customer acquisition, this requires a higher amount of capital than the previous stages.

#4 Expansion Stage – This is when the company’s product is starting to become more mature and they have the assets and reputation to be able to expand, whether this is opening new offices, launching a new product.

#5 Bridge Stage – This is the stage where a company decides to transition into a public company. The business has matured, and it requires financing to support acquisitions, mergers, and IPOs.

Summary

In short, the popular step-brother, venture capital, takes risks on immature companies projecting valuations in the millions. They gamble on the figures and in return take a very healthy stake of equity as their form of payback.

The more mysterious, venture debt, doesn’t support pre-revenue businesses, but unprofitable businesses that are generating revenues of over £1 million (typically post-Series A). You pay interest on the loan to start, and once you’ve achieved your goals, you begin to pay back the debt.

As the quality and quantum of revenues increase, the more you can leverage different debt products and grow your business strategically.

Next up in the final part of the venture debt guide, we will be covering off how it works and what steps you can take next to grow your business with Venture Debt.

If you are interested in looking at Venture Debt vs Private Equity, we recommend heading back to part two here.