It's time for the second instalment in our series, "The BEAR and the VCs," where we pick apart what is happening in the capital markets and what you can do as a business to raise funds.

The smart money is being invested more cautiously than before

When a VC invests they will have a timeline for which they want to have a capital tied up with your business. With the current climate that timeline has increased to an unknown level. So this has changed their investment strategy. A wise investment for them on a growth (series A/B+) goes on a probability of success over a timeline for IPO / exit (through sale, buyout etc,). Or they invest early but with more investments in smaller companies, spreading their risk but on a more predictable timeline.

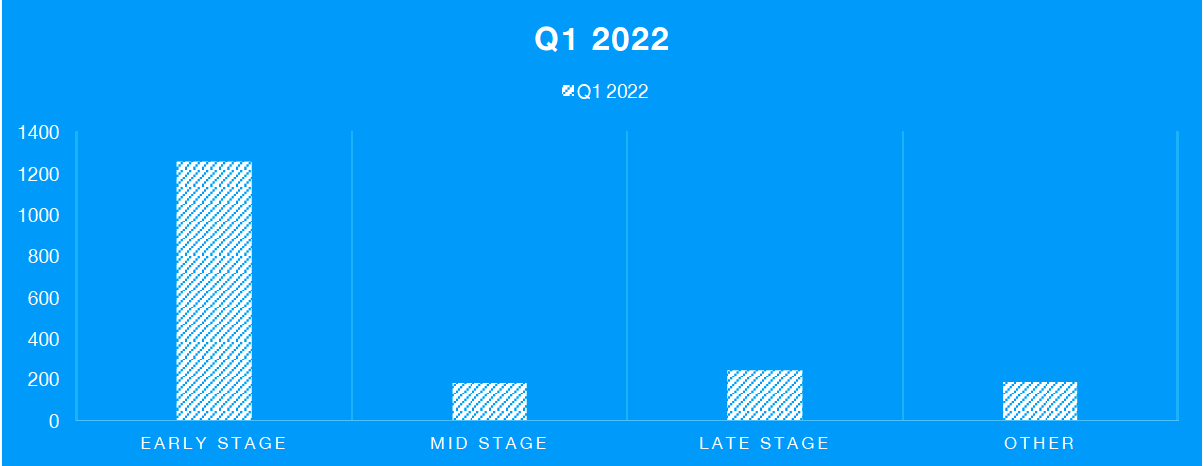

We have seen that early-stage investment is still going strong. Growth companies have a shelf life of 3-5 years. They also have an investment of €10m - 200m. Seed is longer with typical investments being sub €6m. No one wants to suck a lemon right now.

Company valuations have dropped massively in the past 3-4 months. Last year (2021) for tech companies doing a series A, founders were getting an average valuation of 9 times their ARR. This year (2022) founders will be lucky to get 3 times ARR.

That’s a crash of over 30%

For a founder/early investor that’s more painful than chopping chillies and going to the toilet before you wash your hands. It’s gonna hurt. It’s gonna burn. It may even burn for a long time. If a VC invests today the founders will lose more equity and control than many are happy with. No founder wants to lose control of their baby, well, at least not at the wrong time… The VCs I know have done hardly any growth investments this year and they’re not planning to. The main investments they are planning are the SEED stage.

THIS BRINGS A VERY BIG PROBLEM TO TECH COMPANIES IN THE SCALE PHASE.

This is why heroes like Delivery Hero managed to raise 1.4 billion in debt. RITMO raised €200m in debt and Grover split their deal between €110 in equity with €220m in debt. As long as the bear market continues, VCs will be less likely to bet on the growth segment. If they do they will not give the founders a good deal. For a founder, they need to find the right VC with a portfolio that’s not massively stuck at the end of the cycle. Timing is all. Secondary to that is a cultural fit, but that’s a whole other article.

THINGS WILL ONLY GET WORSE IN THE SHORT TO MEDIUM TERM.

It is highly likely we are staring down the barrel of a recession, and after the last two years, it’s been a long time coming. But one thing I do know, one thing I am sure of, is the tech industry is resilient during these times. Why? Because rapid change is in the DNA of a tech business. This makes many tech companies in the seed and scale phase more resilient to change.

WHAT CAN YOU DO NOW TO FILL THE GAP WHILE BURNING CAPITAL?

Read the full e-book or wait until the next instalment.