Did you know that over the past few years, more and more tech companies are turning to private capital from non-traditional sources to finance their growth strategies?

Private capital can support them when they:

- Don't want to give away more equity than they need to

- Prefer to take cost-effective short term debt over equity to help them to achieve growth milestones

But that's not all. Many providers of private capital take a specialist interest in the tech sector. Consequently, tech CEOs and CFOs have learned that they can avoid pointless discussions with banks leading to covenant-laden and restrictive term sheets.

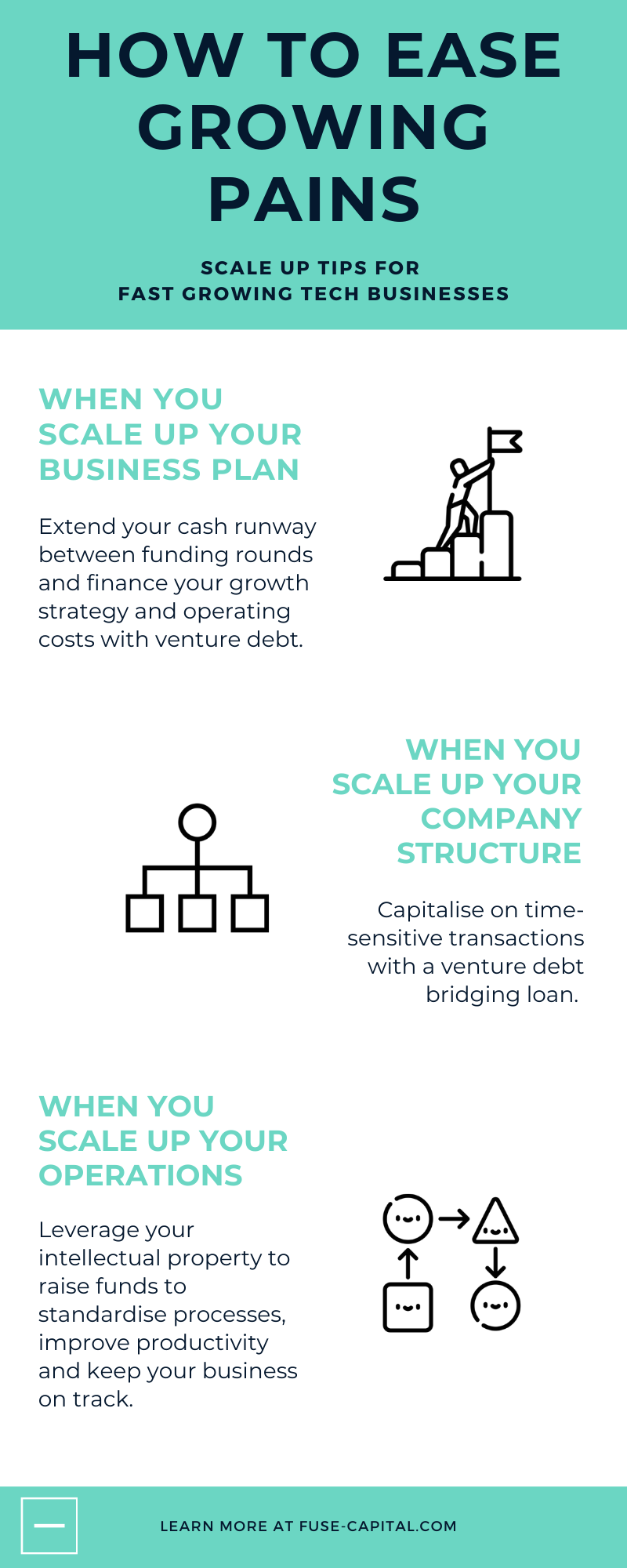

To help you understand how private capital from non-traditional sources can help you to finance your tech business’s growth strategy, check out this infographic:

Key takeaways from this infographic

You'll learn how private capital, in particular, venture debt can support you when you:- Scale-up your business plan

- Scale-up your business structure

- Scale-up your operations

Get in touch with us today to book a free, no-obligation consultation with one of our debt experts.