Thinking about using debt to grow your business, but worried about debt warrants?

It’s only natural to be concerned about making the right financial decision for your business. You don’t want the terms of your finance facility to restrict your company’s growth plans.

You don't want that capital to come with considerable costs, either. Therefore, if you’re unfamiliar with the term ‘debt warrants’, we will explain why they exist, what they are, and what they imply when funding a round of venture debt.

Why Do Warrants Exist?

In the early years, fast-growing tech businesses typically burn cash and take time to turn a profit. For this reason, they’re often considered too risky to attract traditional investors. Debt funds leverage warrants as an incentive to take on the risk.

It's beneficial for both parties: On the one hand, it allows funds to get a piece of the tech boom cake (albeit a small one). While on the other hand, it creates opportunities for pre-profit companies to get exposure to financing, which might not have been the case otherwise.

What Are Debt Warrants, Exactly?

A warrant in debt is similar to a stock option. There are two common warrants you should know about:

- Call Warrants – The lender’s right to buy shares at an agreed price on or before a specified date. The price is what’s known as a ‘strike’ price and it is agreed upon during the deal negotiations.

- Put Warrants – This gives the lender the security to sell a given quantity of shares for an agreed price on or before a date agreed upon during negotiations.

For example: let’s say your company takes out a £1m debt loan with a 5% warrant coverage. Here, you give your lender the option to buy £50,000 in shares at an agreed price on the contract date. The warrant represents the equity kicker.

What Happens When a Lender Exercises its Loan Warrants?

Warrants are only exercised on a ‘liquidity event’, such as a trade sale or an IPO.

If we refer to the earlier example, let’s say your company’s share value has increased by 50% and you decide to maximise profit with an exit strategy. Perhaps you plan to IPO or exit via acquisition, and your lender can use its warrants finance to buy and sell £50,000 of shares. Now that they’re worth £75,000, they yield an ‘equity kicker’.

The Benefits of Warrants:

- Venture debt warrants don’t impede your growth or restrict your deployment of capital.

- They are interchangeable with interest rates and covenants.

- Warrants in Venture Debt are easy and inexpensive to set up.

- They’re cheaper than raising equity.

- It's possible some don't even kick in.

How Much Does Debt Cost With Warrants?

In many loan agreements, a debt fund asks for finance warrants, over equity, of between 5% and 15% of the loan's value.

However, equity kickers are becoming prominent. Equity warrants usually represent 2-4% of equity at exit, but it will only eat up value above a set price. The majority of the time, the set price is your valuation when you contracted the loan. That means these equity warrants are only going to be significant in case of growth, and kick in within that growth, not within pre-loan value.

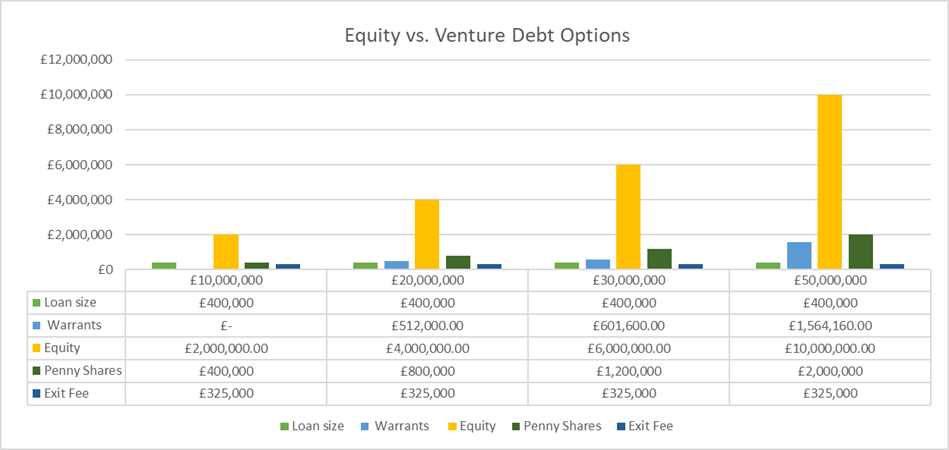

In our article on warrants from a few weeks ago, we detailed how the cost of acquiring capital differed from one option to another. Here's the table we used, so you can visualise a warrants' cost in the long run, compared to, say, VC deals.

The first row indicates the company’s valuation. We imagine a company that took a warrant with a strike price hitting anywhere after £10,000,000 valuation and see how the cost of capital acquisition varies. That's compared to other types of warrants/VC.

For more insight about these other types of warrants, check our last Warrants Update.

At a £50,000,000m valuation, we see that 20% equity dilution will represent £10,000,000mil at exit.

A Warrant, however, will only represent roughly 2-3% of equity dilution, at any given time passed the 10 million valuation threshold.

As you can see, this is a ridiculously small amount compared to a VC deal

In summary

Now that you understand the advantages of warrants, there is one last thing to note. Different debt funds use different measures to calculate warrant financing. To find out how our global lenders calculate their debt warrants, drop us a line, and we’ll set up a time to chat.

Talk to an expert debt advisor and get the most out of your negotiations.