As equity financing falls away, firms need to find new capital to fuel their growth.

The night is always darkest before dawn, or so the saying goes. Yet the thoughts likely occupying the mind of business leaders right now are probably more to do with how long exactly that night is going to be.

At the beginning of the global lockdown, investors and private funds pulled up the drawbridge. Deals that were all but completed were taken off the table at the last minute due to cold feet, while those that did squeeze through did so by the skin of their teeth. The same will happen again.

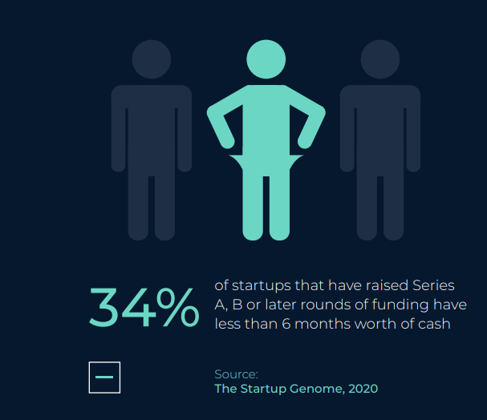

Tech giants may be happy to close mega deals, but the opposite is true of the early stage, where exits are no longer being welcomed. And it’s at this startup and SME stage where firms who might typically burn through cash are now fighting for survival - the capital wasn't there.

WINNERS

Yet, despite this, there are winners. Firms who were either in the right place at the right time to capitalise on seismic shifts in organisational behaviours (like Zoom) and consumer behaviours (like Vivino, an app-based marketplace for wine) and who as a result have seen rapid growth. It could also be firms who have taken a hit on revenue in the short-term, but for whom COVID has been an acute stress test and vindication of their business model.

“There are a lot of winners out there where the fundamentals of their business are sound but they’ve just taken a knock in the short term,” says Russell Lerman, Co-Founder and Director of Fuse Capital, a private debt brokerage for technology businesses.

“For example, the top three e-scooter firms in Europe have all raised hundreds of millions - but they all took a hit on revenue at the start of lockdown. Yet you absolutely knew that people wouldn’t want to get back on public transport anytime soon, and they will do ok. The fundamentals are there and now they’re posting record revenues. A COVID winner is a broader category than simply someone who has seen a rise in sales, it could be they have seen a knock but overall, they’ll be on the up.”

In a normal world, it is precisely these ‘on the up’ SMEs and startups that are most likely to benefit from equity finance. Yet because of COVID, equity finance is now coming with more milestones and growth expectations that companies simply aren’t confident in hitting. In turn, the reduced valuation terms on offer cause the equity round to become dilutive for existing shareholders.

GROWTH DEBT

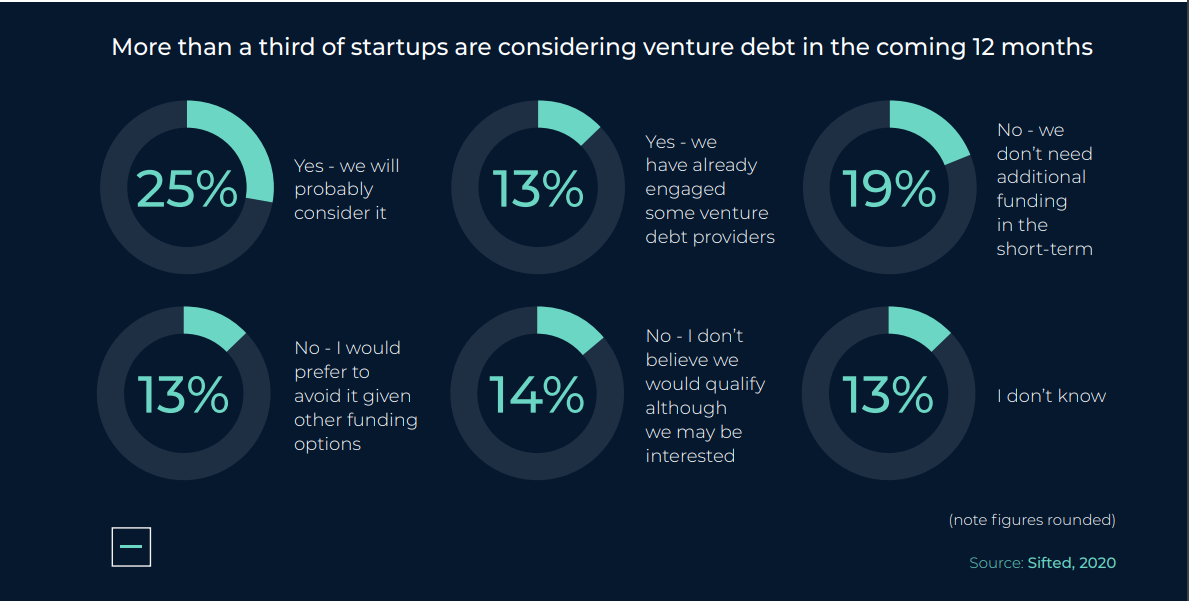

Firms now need to consider other financing options. Venture debt, or growth debt, is one avenue worth considering.

“We only want to raise equity funding when we’re confident that we can do something productive with it in the business,” says Donald Gillies, CEO of PassFort, a SaaS firm that digitises customer lifecycle management, and who is considering venture debt to support growth achieved during the pandemic. “We see venture

debt as a way to offer a bit of a capital buffer and to protect the business at this stage.”

With sales cycles lengthening, it can be challenging to hit the profitability milestones set by equity investors. In this case, having some debt come into the business can give firms the operational buffer required to trade through that period while waiting for pipeline revenue to convert. Similarly, for firms who have managed their cost base well, debt can offer a degree of protection against a second wave.

Professor Eli Talmor, Chair of Private Equity at London Business School agrees that debt can be useful for firms: “I see the role of venture debt growing, especially as exits are now postponed. If you have an extension of time between that original investment, early-stage, and exit, say one or two years, then a lot of it can be funded with venture debt.”

Oliver Blower, CEO of VoxSmart, a software company in the UK that specialises in

communications surveillance for Capital Markets, is another advocate of debt financing. Blower describes debt, or an all asset charge on the business, as an “antidote” to equity. “It creates a nice bit of hygiene in the business,” he says. “It comes with operational parameters that keep your stakeholders very honest about

how they are operating their business. You can’t miss your forecasts; you have to be very prudent because any level of dishonesty will hurt you and your shareholders quite dramatically.”

THE RISK SPECTRUM

So, while debt offers a number of benefits - including growth capital, an operational

buffer, and a way to avoid equity dilution in the face of unfavourable terms - it’s not for everyone. There is a time and a place. It takes a certain type of personality.

Russell Lerman, who has worked with dozens of firms to secure debt funding over the years, believes that it depends where you sit on the risk spectrum. “With any debt, you need to be able to afford to pay it back - so are you confident in launching new projects and reaching new audiences? Or are you worried about what’s coming around the corner?”

To ensure that debt is the right choice, Russell Lerman suggests firms ask themselves four key questions. How does the company feel about it?

Is the management team ready to go on that debt journey? Is an external third party - like a broker - comfortable with it? And finally, will the lender say ‘yes, this is going to work’?

Ultimately, every company is different, and every management team and shareholder base is different as well in terms of their attitude to risk.

But for those firms who are confident in their future revenue and are ready for the journey, bringing some debt into the business might just be the best way of fuelling their growth prospects in the current environment.

👇👇To read the full e-book drop your details in the form below 👇👇