Tales Of The Party

Coming out of the pandemic, I personally experienced a handful of unhinged parties that felt wrong, a bit too crazy to be reasonable: no one is taking precautions, and all seem to only care about enjoying the moment, whatever the repercussions.

A glimpse of newfound normality sufficed to give everyone unmitigated hope in the future, the promise of better times. We paid the price once, we went through hardships, and now was a time of positivity, high aspirations and ambition.

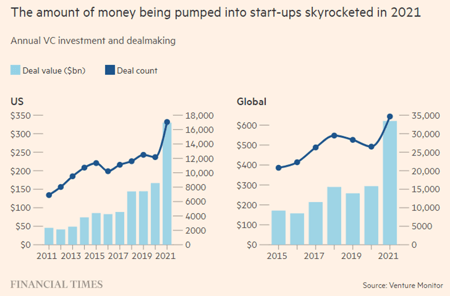

Parallelly, 2021 felt like a dream for VC funds and the companies they backed. Persuaded that the pandemic drastically changed people’s habits and needs, VCs experienced a positive frenzy and funded practically any startup that banked on this promise of radical change in behaviour. This resulted in the greatest funding year...like ever...

Never had we seen valuations so high for companies so underdeveloped.

One-upmanship, lack of realism, a tendency to fund mega-rounds or nothing, coupled with a crass disdain for due diligence processes, was the name of the game. And it was fun while it lasted.

It didn’t last long, however, and very soon, reality caught up to everyone. There was not much respite spanning from the effective end of the pandemic to the Russian invasion of Ukraine, which rang a metaphorical wake-up alarm. The dream, the party, whatever 2021 ended up being, was over.

Sobering Up

Returning to Earth affected the economy and the overall market, but how?

According to data from Crunchbase, venture funding decreased by $90 billion (53%) in the third quarter of 2022 compared to the same period the previous year, and dropped by $40 billion (33%) compared to the second quarter.

As a result, Q3 2022 saw the slowest quarter for VC funding since the beginning of the pandemic.

Within the VC ranks, at the time Q3 2022 data were released, the general injunction was not to panic in the face of a fleeting bull market.

Klarna became the poster child for VC's funding fails, when the Swedish buy-now-pay-later company reported a valuation of $5.9 billion in July 2022, 87% less than what its venture capital backers had estimated it worth to be the year prior.

What Now?

What happens after sobering up? Is there a prospect of betterment, what are trends and predictions that typically come up, and are they to be trusted?

Forbes released twelve testimonies/predictions for 2023. Some of these testimonies are cute PR operations from the funds involved. However, a couple of them seemed more genuine.

Here’s an example and it comes from Sophia Bendz, a General Partner at Cherry Ventures, about founders’ resiliency:

“My prediction isn’t so much what will happen in 2023, but what changes 2023 will create in the long term. The year will be rooted in the still-tough market and macro environment of 2022, and that will produce a generation of founders that are more robust, more strategic, more determined, and far more resilient than those we’ve witnessed in the past decade.”

And she’s not wrong: typically, not only do tough climates tend to eliminate lame ducks, but it also creates a generation of businesses which are more apt to survive, whatever the conditions.

Mar Hershenson, Managing Partner at Pear VC, shared his thoughts on the immediate future of VC’s behaviour:

“We will see more real companies and better investors. Less money in the system means companies need to have better operational excellence (do more with less money). Investors are also going back to basics. Diligence is back, along with an appreciation for companies that are building real value, not relying only on future value.

Less founders. Less investors. More opportunities. When it is harder, the tourists leave.”

And that sounds about right: They’ve paid the price of DD negligence and expensive, wishful backing of companies that produced no concrete value in the present. A return to common sense then?

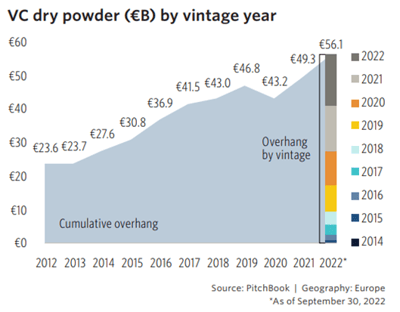

There is also a general feeling that 2023 will be about carveouts, tactical M&As, consolidations…anything that makes a company stronger, leaner, and more focused on its product rather than accumulating a chaotic jumble of a war chest. VC funds are most certainly going to make such companies favourites and sit on the rest of their dry powder until the cataclysm has passed.

By the way: 2023 will see a record €60 billion of dry powder in the European VC ecosystem.

There is a logic to this, which could be explained thereby:

“The end of the latest bull run has forced a hard reset for many Limited Partners (LPs), and they’re re-evaluating the venture managers they want to prioritize partnerships with for the next decade-plus. I think 2023 will bring pronounced LP churn as they look to rebalance their portfolios and focus on those with long-term return potential, which likely also means shedding the overall number of venture funds backed.”

by Clarkson, Partner at Sapphire Partners

This hard reset for LPs could explain why VC funds are sitting on their dry powder: They are not expecting great fundraising prospects, so they’ll hold on to what they already have and wait for the right time to strike.

This could lead to exactly the reverse effect of 2021: instead of considering every other startup as a golden goose, VC funds could fall to the other extreme and underfund throughout 2023.

Are There Alternatives?

And by alternatives, we mean a way for high-growth tech companies to get access to funding while VCs are going through their hangover.

Well, if your company has raised money in 2021, you've probably hit a crunch and might need funding quickly. Whether it's to unlock more growth, hit benchmarks, or have a bigger runway, private debt can be the alternative for your company.

Deal flows remained stable since Q3 2022, and on top of that, you will not dilute equity. This is especially good if you're planning to find some financial leeway while VCs recuperate, and hit a round in the equity market once things have stabilised.

If you have any questions about accessing debt facilities fill out the form below to get in touch with one of our advisors, no strings attached!

.png)