Introduction

Often used by companies with a clear use of funds, mezzanine finance is a creative route to capital.

Cleverly combining parts of both equity and senior lending, mezzanine debt is often overlooked as many believe it to be expensive and complex.

But, for the ambitious business, this alternative finance can mean the difference between stagnation and growth.

By the end of this guide you will have everything you need to explain mezzanine debt financing to your associates. You will also understand how it can support your growth plan and the next steps to do so.

Use the contents section below to skip to specific areas of interest.

CONTENTS

| 1. Introduction

2. Use of Funds |

13. Conclusion |

*Estimated reading time 9 minutes.

Use of Funds

Mezzanine finance has been helping businesses to achieve their goals since the 1980s. It coincided with the Junk Bond Market (which was later busted) and the LBO craze of that era.

These are the top five business milestones that can be reached with mezzanine finance:

- Growth

- Mergers and acquisitions (M&A)

- Cashing Out

- Gap/Bridge Financing

- Refinancing

Benefits of Mezzanine Finance

Mezzanine debt opens doors, and if your business needs to take a step in a new direction, options are everything.

Here are seven more reasons to consider a mezzanine debt facility for your business.

Benefit 1 – Compared to the cost of equity alone, mezzanine debt costs less.

Every business has a different capital structure. The general rule of thumb is equity is expensive and senior lending, cheaper. But, if you’re raising capital and in short supply of senior options, mezzanine is next best.

Benefit 2 – No need for an extra seat at board meetings.

It’s very uncommon for mezzanine lenders to get involved in your business strategy or day to day decisions. However, during some meetings, a board observer may expect to remotely join the call, with no input as they will sit on mute. Alongside this small requirement, meeting the covenants which were set out in the loan contract and providing a regular financial report are likely to be all that is needed.

Benefit 3 – Interest on debt is tax deductible.

It really is as simple as that, the interest you pay on the loan can be deducted from your tax bill.

Benefit 4 – It’s not as rigid as the big banks.

The beauty of mezzanine funders is that they are not constrained by the same rules and laws as the banks. Their small size allows nimble thinking and flexibility. They will also likely relate to your entrepreneurial mindset. A win-win for both.

Benefit 5 – Refinance it later to reduce cost of capital.

Once your mezzanine money starts paying off and you start hitting targets, your business is going to look more attractive to senior lenders. Typically, companies restructure their junior debt with senior debt at a later date. Look at mezzanine debt as a stepping stone, it’s the best deal for today, but perhaps not the best deal in the future (provided your strategy is paying off that is).

Benefit 6 – Mezzanine finance is the express route to growth.

If you fit the criteria for lending, a mezzanine debt deal can be achieved in under 90 days. Speak to our debt team today if you’re in a hurry here.

Benefit 7 – Your goals come first, pay it back at a later date

Expect a favourable schedule that enables you to prioritise your goals before paying anything back. Skip ahead to Repayment Terms if you’d like to know more.

Risks of Mezzanine Finance

Let’s explore the other side of the coin so that you can understand the risks associated with private debt mezzanine.

Risk 1 – Compared to senior debt, interest rates are high.

Should a business go into liquidation, we know that the senior debt gets paid first and so, there is a risk that the mezzanine lender may not see their return. This is why mezzanine lenders look for a higher return due to their unsecured nature.

Risk 2 – You may lose more equity than you planned.

We know that every deal is done with the intention of success, but should something unexpected happen such as an economic downturn and you can’t meet your repayments, equity may well be required to bridge the gap. Obviously, any equity warrants would be agreed in advance, so this would never come as a surprise.

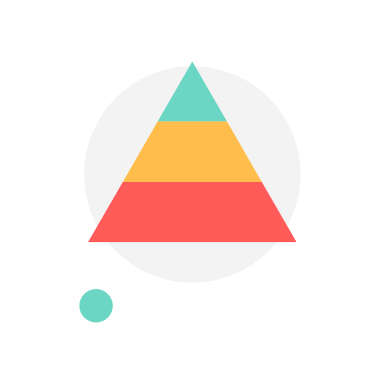

Types of Structure

In an established company, a common financial structure will include all or any combination of the following:

- Senior Debt (Secured)

- Asset Finance (Secured)

- Unitranche (Mixes 1 and 2 together) + Subordinated or Junior Debt (also secured)

- Unsecured Debt

- Mezzanine Debt

- Preferred stock

- Equity

With a little know-how and some foresight, you can combine different types of capital for a reduced-cost structure.

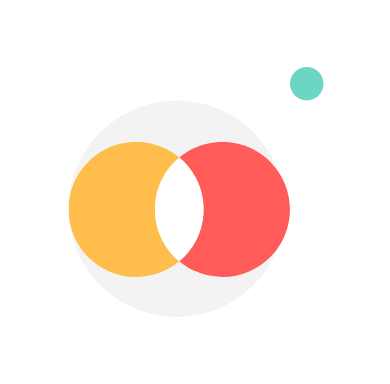

The graphic below shows an example of an efficient financial structure.

You can see that 20% – 30% of the total is gained via mezzanine funding. This results in a reasonable overall cost of capital due to minimal share dilution.

What are the different types of mezzanine structures?

If you’re wondering how to model mezzanine debt, understand that it can be structured as unsecured or as preferred stock. You should know which type will suit your business best, but if you don’t our friendly team of experts will happily talk you through it.

Does Mezzanine Debt have Covenants?

Like with any loan, your agreement will have certain legal clauses, known as event defaults or covenants.

If you would like to find out the secrets to covenant-lite private finance, we suggest reading our other blog here.

Alternatively, read on to download a recent client term sheet with details of the actual covenants and deal structure.

Repayment Terms

One of the number one mezzanine debt rewards are the favorable repayment terms (also known as Amortization schedule). They are designed so that you can go and do what you want to do without the need for any immediate repayments.

Typically, our funders request a relatively small interest payment on a monthly basis. The balance of the interest and remaining loan are to be paid at the end.

Monthly Interest Example

If you borrow £10,000,000 and you pay 5% cash interest rate you will pay £41,750.68 per month.

After a material liquidity event, some private debt funds will trigger a small equity warrant. The types of events which will trigger this type of payment are as follows:

- Your shares are launched onto the stock market (IPO)

- You exit the company

- You carry out a large equity raise

Be aware of these common mezzanine debt costs in this free downloadable term sheet:

- Arrangement Fee

- PIK Interest

- Variable Fee

- Early Repayment Fee

- Cash Interest

- Duration and Term Info

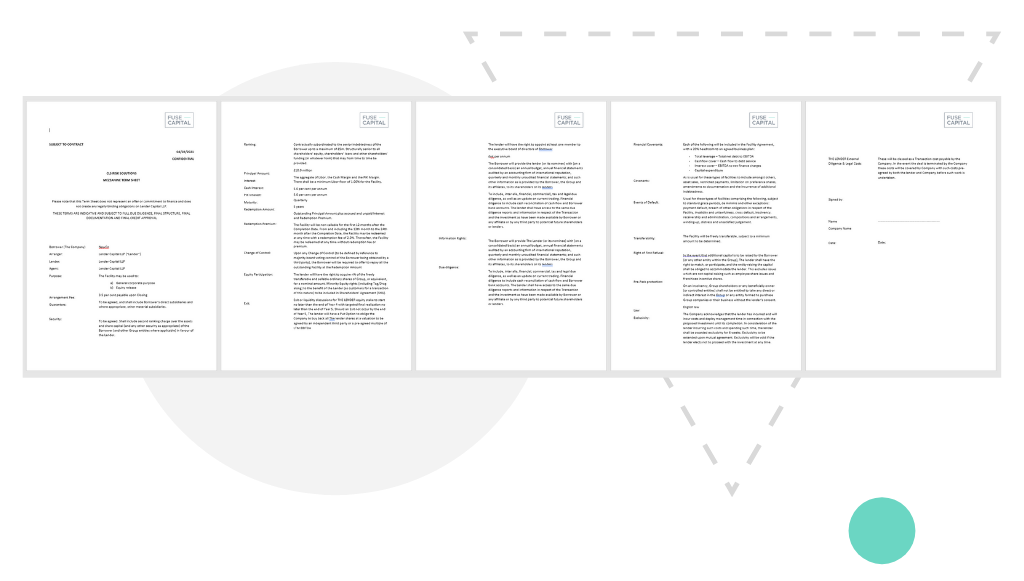

Downloadable Term Sheet

Find out the exact costs associated with a £10,000,000 mezzanine loan in this free downloadable term sheet (also known as an ‘Offer’ or ‘Expression of Interest’). These are the actual costs for a deal that was signed and delivered to one of our clients.

Click on the image below to download.

Who Can Borrow?

By now you should have a good understanding of what the benefits, risks and costs of borrowing are. In this section it’s all about eligibility.

Is your company eligible for mezzanine debt?

It doesn’t matter what industry you’re in, all that matters is the company earnings before interest, taxes, depreciation and amortization (EBITDA).

Provided you’re dynamic and have a run rate of at least £1,000,000 million EBITDA per year, you’re in a position to seek mezzanine debt deals.

One of our clients, an Industry Leader in Insurance, with an EBITDA of £6,000,000 recently borrowed £10,000,000 in private mezzanine debt.

If you would like to read how mezzanine capital solved a complex problem for our client, you can read the full ins and outs here.

How Much Can You Borrow?

The limit of borrowing will be dictated by the individual fund you’re dealing with and of course, you own affordability.

At Fuse Capital we don’t lend under £2,000,000 or over £25,000,000, and we specialise in working with technology firms. You can find out who we like to work with here.

How to Choose the Right Fund?

When it comes to any deal, the devil is always in the detail, and so, you need to run a competitive process with multiple funds. Give yourself options to choose from.

Costs, structures and covenants are all going to be specific to your company. The deal that suits your financial needs best is most important of all. However, depending on your company, here are some other factors to consider to help choose the best debt fund:

Track Record

How long the fund has been in business for is a clear indication of their success. You should take a look at how much they have raised and how much they have invested. Don’t be a guinea pig.

Transparent Source of Funds

Are you involved in Impact Investing? If so, your business will be committed to environmental, social and governance initiatives. A clear source of funds will be expected.

Industry Expertise

A fund that is experienced in your sector will understand your business better. This sort of alignment may be of value to you and sets you up for a smoother transaction.

Geography

The majority of debt funds are located in the USA, however, this does not limit you to the US alone. Language and time zones should be considered, perhaps you want to work with a fund a little closer to home.

We can link your business to an experienced fund whose understanding of your sector will be mutually beneficial.

Alternative Options

If Mezzanine Debt isn’t for you, there are other options available.

Revenue Based Funding or Royalty Based Funding is where investors provide capital in exchange for a fixed amount of future revenues. This amount will usually match the companies’ profits, so if they start to earn more, the investor does too.

No doubt you’re already familiar with Equity Investments from Individuals like Angel Investors or firms like Venture Capitalists and Private Equity. As you’re reading about Mezzanine Finance, your business is likely already very successful, and so you’ll be aware that selling shares of your company in exchange for capital is a very expensive and convoluted way to grow.

A Convertible Loan Note is unique for its transformational ability. Like with any normal loan, it comes with interest payments and needs to be paid off entirely within the agreed term. However, what’s interesting about this type of finance is that if the business carries out a round with substantial results, the loan plus the interest, converts into company shares.

Launching your business’ shares onto the stock market (IPO) is an objective for many. If your business is viewed favourably, you’re bound to raise large sums of capital. But, in exchange for the valuable raise, you could lose considerable ownership and control. This may affect your future success.

Unsecured lines of credit are a common method of borrowing. Interest rates are usually high and covenants strict. Like with any loan, there are risks if used irresponsibly, but they also serve their purpose. For mid-market companies, you would need to approach your bank to acquire an unsecured line of credit.

Common Misconceptions

1 ) Junior Debt vs Mezzanine?

Junior debt and mezzanine debt are essentially the same thing. Junior debt is simply a classification which indicates where the debt sits within a capital structure. Junior debt or Mezzanine debt sits lower down the repayment priority list should the company go into liquidation. You can read more about structures here.

2) What is the Difference between Mezzanine Debt and Subordinated Debt?

Mezzanine Debt and Subordinated Debt are also the same thing. Subordinated debt is simply a classification which indicates where the debt sits within a capital structure. Mezzanine debt or subordinated debt sits lower down the priority list should the company go into liquidation. You can learn more about it structures here.

3) Preferred Equity vs Mezzanine Debt?

There isn’t much difference between Preferred Equity (also known as preferred stock) and Mezzanine Debt. They both have similar characteristics. Preferred Equity is a percentage of shares which sit above common equity which offer more security to the lender. When combined, Mezzanine Debt and Preferred Equity are considerably cheaper than Common Equity. It doesn’t really matter which one you choose, it’s about the individual deal and the outcome you want.

4) Second Lien Debt vs Mezzanine Debt?

Second Lien Debt vs Mezzanine Debt are also the same thing. Second Lien debt is simply a classification which indicates where the debt sits within a capital structure. Mezzanine debt or Second Lien Debt sits lower down the priority list should the company go into liquidation. You can learn more about structures here.

5) Mezzanine Financing vs Convertible Debt?

The difference between Mezzanine Financing and Convertible Debt is as follows. Convertible debt tends to have lower interest payments up front but a more expensive equity dilution later on. Mezzanine debt has higher interest payments to begin with and a lower equity participation (also known as mezzanine debt warrants). Overall, Mezzanine Finance incurs less cost in the long run.

Conclusion

Now you should have a good understanding of Mezzanine Debt and how it can be used to grow your business. It’s likely you will have some questions which are specific to your business which we are happy to answer.

At Fuse Capital, we connect businesses like yours with the best and largest debt funds in the world. We are regulated by the financial conduct authority and are renowned for our innovative thinking and understanding of the market.

If you would like to discuss the possibility of engaging with a Mezzanine Capital Fund to invest in your business, book a free, 30-minute, no-obligation meeting with our founder today. Simply get in touch now.

If this article has been helpful and you know someone else who may benefit from it, please share.

We are Fuse Capital, mezzanine finance providers UK, offering international connections for ambitious businesses in tech.